Tennessee’s “fiscal conservatism” looks good on paper—but when taxpayer dollars fund unconstitutional programs and protect corporate interests over people, it’s not conservative at all. Justice, not balance sheets, defines real conservatism.

By Colson Potter For TruthWire news

What’s the value of fiscal conservatism? Tennessee has pride in its balanced budget, pride that politicians like my current state senator, Jack Johnson, love to trade on. We have also many small business owners, entrepreneurs who have put their blood, sweat, toil, and tears into making a good living for their families. The words ‘pro-business’ and ‘fiscally responsible’ sound very good indeed to these people. We should ask, however, what these principles really mean in the mouths of our politicians.

Fiscal conservatism by itself is worthless. Scrooge was ‘fiscally conservative,’ and nobody would call his miserdom ideal. The point of fiscal conservatism is its use in supporting good governance, conservative governance, in general. A government which saves money by allowing injustice is like a parent who saves money by not feeding his kid. Fiscal conservatism without conservatism, without justice, is not only worthless but harmful.

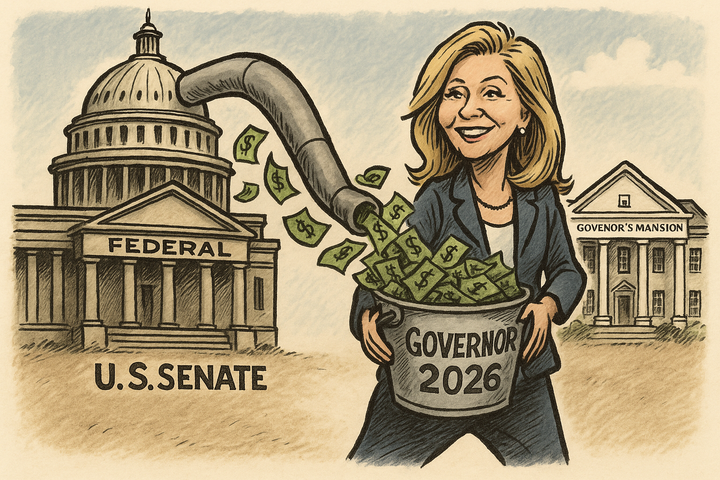

Today, we have two areas in particular to inspect: what the government spends its money on and how it promotes business. I chose these aspects from the rest for a reason. While only a section of the policy ‘fiscal conservatism’ deals with, they are significant elements (as recognized by Jack Johnson, who extols his own fight for “strong fiscal discipline” and for “business-friendly policies”); more, they are areas where our current government, under Republican leaders like Johnson, has betrayed the people. The government, in blunt terms, has spent money where it oughtn’t (morally and legally) and has sought to enact ‘pro-business’ policies at the cost of justice.

The first of the two bills we’ll consider today is Johnson’s own SB6001, the successful school voucher bill pushed through in Gov. Lee’s mid-session special session. According to its own fiscal note, the bill’s firs-year cost to implement is $145,920,000, rising to $188,100,000 in the next year and not stopping there (Page 4). Note that I’m only considering the cost of the school vouchers here, not the other measures bundled into the bill. Quite possibly, therefore, the bill could be a billion-dollar proposition within 5 years.

If we assume the program started in the current fiscal year (which is not quite correct, as far as I’m aware), and that the current year’s state revenue will be c. 3% higher than last year’s (based off 2025-6 in comparison to 2024-5), $6 out of every thousand would be going to this program, more than half a percent. Not a lot, you might think, but balancing the budget means increasing taxes to match (or using morally dubious means like the state lottery to prey on citizens’ financial recklessness).

All this could probably be justified if the school vouchers promised by the bill were a worthy endeavor. They aren’t.

As I laid out in this article, the subsidy granted by Johnson’s SB6001 is not consistent with the Tennessee constitution, which gives the government no right to spend money on pre-secondary education outside providing a free public school. That illegality is bad enough. We don’t want our ‘conservative’ Republican politicians championing unconstitutional expansions of government activity. What’s worse is that this is an expansion of government power (government funding is eventually a means of control) into the family’s right to educate. Yes, taking the money is voluntary, but the program is designed to tempt parents into giving the government a say in how their kids are educated. (And government education always goes wrong eventually; governments just aren’t supposed to be in that business).

Spending money illegally and immoral isn’t really “government waste;” so far, Johnson’s boast has some weight. Tennessee, as we see, isn’t merely wasting money. Tennessee is actively using that money to violate its own charter and God’s law. No, the amount spent isn’t a massive portion of the budget (though it’s a government program and therefore will be remarkably inefficient). The principle is the problem. Christ warns us that, “One who is dishonest in a very little is also dishonest in much” (Luke 16:10). If our ‘fiscally conservative’ politicians are unfaithful with the $146M we’re looking at here, can we be trust them to be faithful with the $23,000M state revenue? Perhaps not.

So the way the money is being used in our state government is less than ideal. As a result, the character of Tennessee’s current ‘fiscal conservatism’ looks a bit dubious, but perhaps it can be brought back. Are our pro-business policies at least unobjectionable?

Some of them, yes. All of them?

Government has a bad habit of preferring looks and money to the health and well-being of its citizens. The Almighty GDP beckons, and politicians wander after it, siren-struck and hankering for lotuses. This sort of thought underwrites many pro-immigration arguments. It also justifies abusive ‘pro-business’ legislation, legislation which forgets protecting people and forgets justice in favor of a better balance sheet. It justifies fiscal conservatism that conserves only the fiscal.

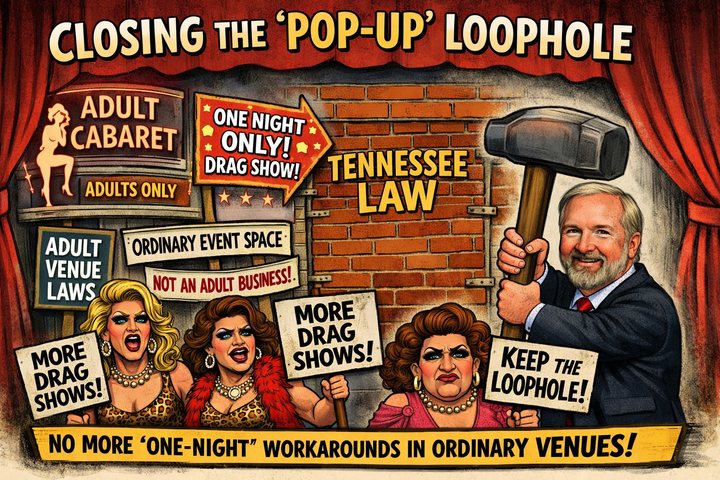

Of such an evil character is the not-yet-passed SB0527, which will be the subject of the Tennessee legislature’s renewed consideration in the upcoming 2026 session. SB0527 has already passed the Tennessee senate, with an ‘aye’ from Senator Johnson on both recorded votes. The bill proposes that it empowers farmers to produce more food, to the benefit of Tennessee as a whole. The way it empowers those farmers, however, is to bar them from suing pesticide manufacturers for fraud related to the effects of their pesticides, unless the federal EPA rules that the label is fraudulent, something the EPA has no mechanism to do (26:00). Note also that a pesticide’s EPA label is written by the pesticide’s manufacturer, and that they have been found to have been fraudulent in writing such labels (20, 34:00). In sum, then, Tennessee’s legislature is contemplating protecting big businesses from going on trial for poisoning and killing Tennesseans.

Possibly this law is fiscally conservative, given the (short-term) benefits to the agricultural industry. Big Agriculture will certainly appreciate it, as they rely on pesticides to help pump out massive amounts of barely-passable food. If we account for the cost of medical care for the injured, as well as the opportunity cost of all the people who are injured or whose loved ones are injured, the calculus looks much less justifiable. That’s beside the point. The point is: do we want fiscal conservatism that sacrifices our and our children’s health in order to bump the economy a few notches higher? That protects big business (with their lobbying budget) instead of the farmers who grow our food and the people who eat it? That discards justice?

Tennessee should be pro-business; Tennessee should be fiscally conservative. Tennessee, however, must not sacrifice its character, its morality, its children on the pretext of financial prudence. Senator Johnson can talk about “stopping unnecessary regulations that burden families and businesses,” but what the Tennessee government actually selling is misuse of funds and protection of poisoners. If this is fiscal conservatism, I want none of it. It’s not fiscal conservatism, though, because it’s not Conservative. Tennessee’s fiscal conservatism must care for our God-given liberties (education) and for the protections providence has assigned those liberties (the right to bring suit before a jury of our peers). Such integrity is how we keep making this Tennessee a better Tennessee, for ourselves and our children.

If you support what we do, please consider donating a gift in order to sustain free, independent, and TRULY CONSERVATIVE media that is focused on Middle Tennessee and BEYOND!

COME TO OUR EVENT FOR A GREAT EVENING OF BBQ AND GRASSROOTS PATRIOTISM!! SCAN THE QR CODE, OR CLICK HERE!!

Comments ()